Nigerian financial technology company OPay has announced a temporary pause in onboarding new customers and creating new wallets.

This decision comes in response to a recent directive from the Central Bank of Nigeria (CBN), as several other fintech companies have taken similar steps in this regard.

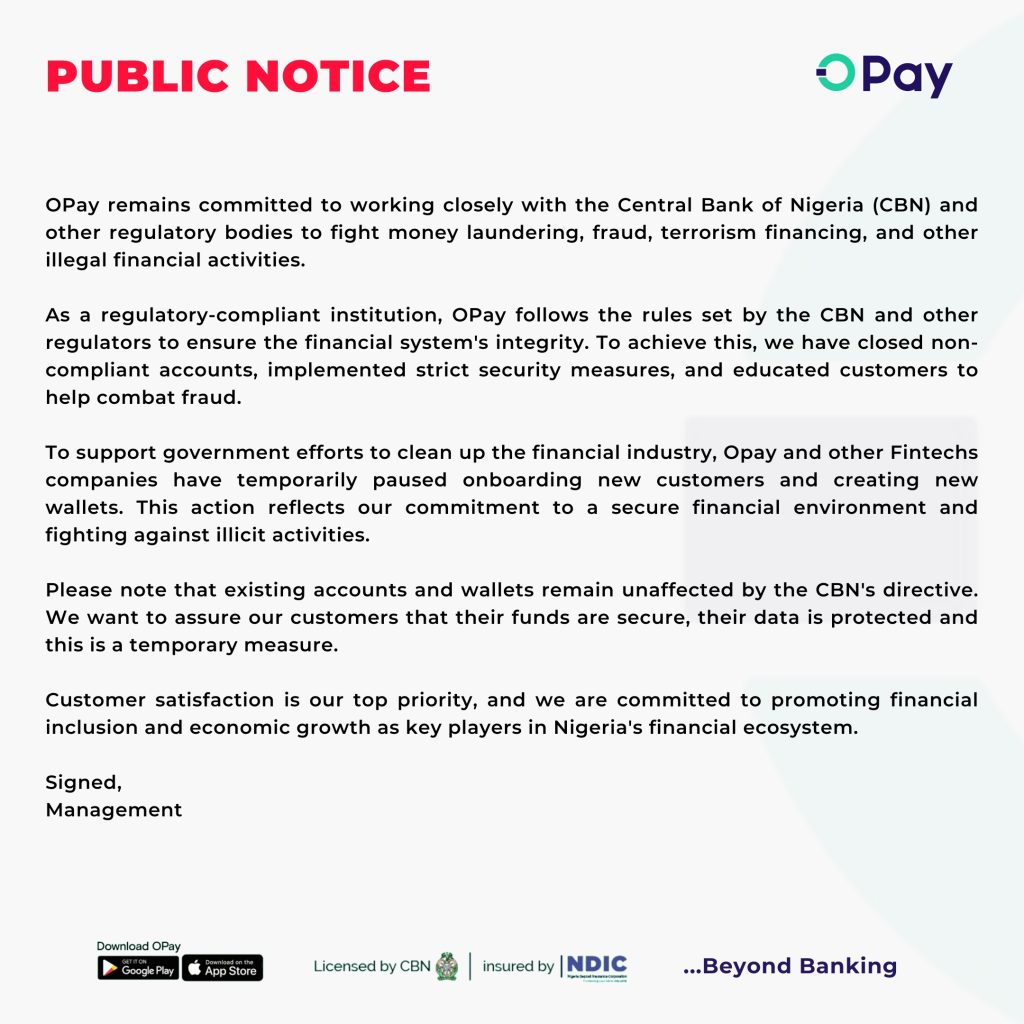

OPay’s management issued a public notice on Tuesday clarifying the CBN’s directive, and assuring customers about the safety of their funds.

News Central reports that Nigeria’s apex bank directed OPay along with three other fintech firms namely; Kuda, Moniepoint and Palm Pay to suspend onboarding new customers due to suspected involvement in illicit foreign exchange transactions.

OPay restated its commitment to collaborating closely with the CBN and other regulatory bodies to combat money laundering, fraud, terrorism financing, and other illegal financial activities in the country.

“As a regulatory-compliant institution, OPay follows the rules set by the CBN and other regulators to ensure the financial system’s integrity,” the statement read.

“To achieve this, we have closed noncompliant accounts, implemented strict security measures, and educated customers to help combat fraud.

“To support government efforts to clean up the financial industry, we and other Fintech companies have temporarily paused onboarding new customers and creating new wallets.

“This action reflects our commitment to a secure financial environment and fighting against illicit activities,” the public notice read in part.

In its statement, OPay reassured the public that existing accounts and wallets will not be affected by the recent directive from the Central Bank of Nigeria (CBN).

The company also reassured customers that their funds remain secure, and data well protected despite the temporary pause on onboarding new customers and creating new wallets.