In Nigeria, Corporate Income Tax payments for Q2 2024 soared compared to the first quarter of the year.

The National Bureau of Statistics (NBS) reports that the Corporate Income Tax (CIT) was N2.47 trillion for Q2 2024, a 150.83% quarter-over-quarter rise from N984.61 billion from Q1 2024. The increase was seen when compared to the N1.53 trillion amassed at the same time last year.

In Q2, local payments hit N1.35 trillion, of which N1.12 trillion came from foreign CIT payments.

According to the report, the industries with the highest growth rates were manufacturing (414.15%), the banking and insurance sectors (429.76%), and agriculture, forestry, and fisheries (474.50%).

On the other hand, the growth rate of activities of households as employers, undifferentiated goods- and services-producing activities of households for personal use saw a decrease of -30.22%, while activities of extraterritorial organisations and bodies experienced a decline of -15.67%, showing the lowest growth rates.

Increased Corporate Income Tax (CIT) payments could give the Nigerian government a much-needed cushion to finance infrastructure projects, social programs, and other essential areas without relying heavily on debt.

Although subtle, given the current economic situation in Nigeria, the rise in CIT revenue may also indicate an improvement in company profitability across various industries.

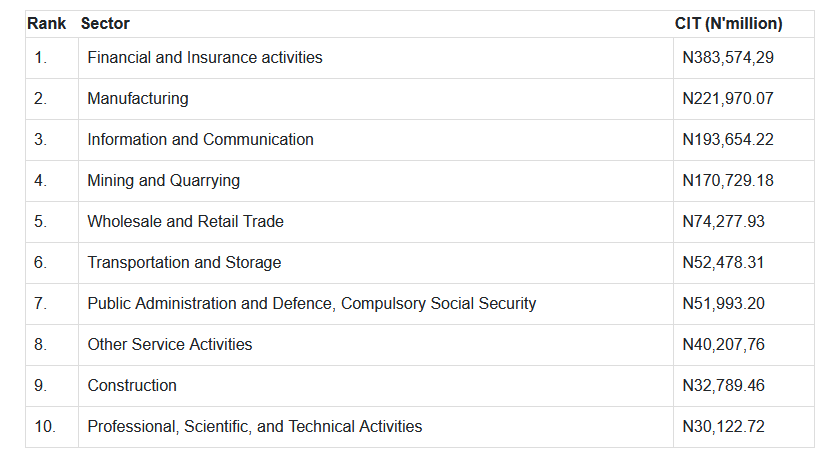

On that note, here are the ten sectors that contributed the most to the country’s CIT payments.