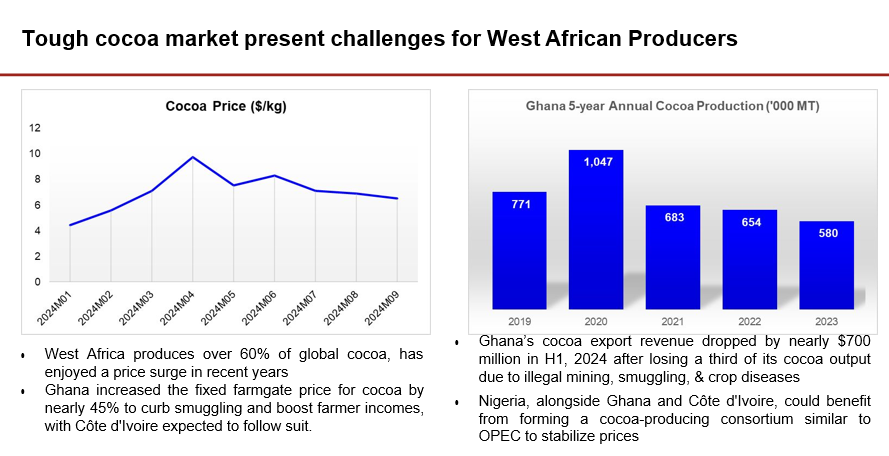

The global cocoa market, a $100 billion industry, leans heavily on West African producers, particularly Ghana, Côte d’Ivoire, and Nigeria, which account for over 60% of worldwide production. Recent price surges have bolstered regional economies, but unforeseen challenges now cast a shadow over West Africa’s cocoa industry. Illegal mining, crop diseases, and smuggling have led Ghana alone to suffer an astonishing $700 million revenue loss, highlighting the vulnerability of the region’s cocoa supply chain.

According to a report prepared for News Central by SBM Intelligence, Ghana’s recent response to the crisis has been to raise the fixed farmgate price for cocoa by almost 45%. It is hoping this will curb smuggling by offering fair compensation to farmers and boost local incomes. Côte d’Ivoire is expected to follow suit, reflecting the severity of the situation. Yet, even with these measures, the problems facing West African cocoa producers remain complex, requiring a coordinated strategy that might go beyond individual policy adjustments.

Many argue that a collaborative consortium, akin to OPEC, could empower West African countries by stabilising prices and countering the volatility inherent in global commodity markets. With such a model, Ghana, Côte d’Ivoire, and Nigeria could wield collective influence, setting policies and standards to improve pricing and transparency within the cocoa trade. It would not only give producers leverage on the global stage but also provide a safety net against external pressures, including shifts in demand and changes in consumer tastes driven by sustainability concerns.

In Nigeria, reforms within the cocoa sector have had a ripple effect on its domestic economy. While cocoa exports alone cannot sustain Nigeria’s GDP growth, recent strides in oil revenue, a slight decrease in inflation, and rising capital importation signal a cautiously optimistic economic outlook. Nigeria’s GDP growth, climbing 3.19% year-on-year in the second quarter of 2024, paints a hopeful picture amid otherwise challenging domestic economic circumstances, including persistent inflation, a depreciating naira, and an ongoing national debt crisis.

For West Africa, the stakes of protecting its cocoa industry extend beyond immediate economic gains. Cocoa is woven into the region’s social and cultural fabric, with millions of farmers relying on it for their livelihoods. If illegal mining and other issues continue unabated, it could erode the foundations of rural economies, drive up migration, and compound social issues already exacerbated by economic hardship.

Thus, while Ghana’s farmgate price increase is an important step, West Africa may need a larger cooperative approach to safeguard its cocoa sector, secure better returns for its farmers, and ensure the industry’s sustainability for generations to come.