When an African country has a large total outstanding IMF credit, it suggests that the government has borrowed a substantial amount from the International Monetary Fund (IMF) and has yet to repay it.

IMF loans can often be a double-edged sword, providing temporary relief while also leading to a potentially burdensome debt. This situation can have various consequences. A high level of IMF borrowing increases a country’s overall debt, which requires careful fiscal management. Such planning might limit the government’s ability to invest in development programmes and social services.

Additionally, these loans often come with conditions set by the IMF, placing further constraints on the government’s financial flexibility.

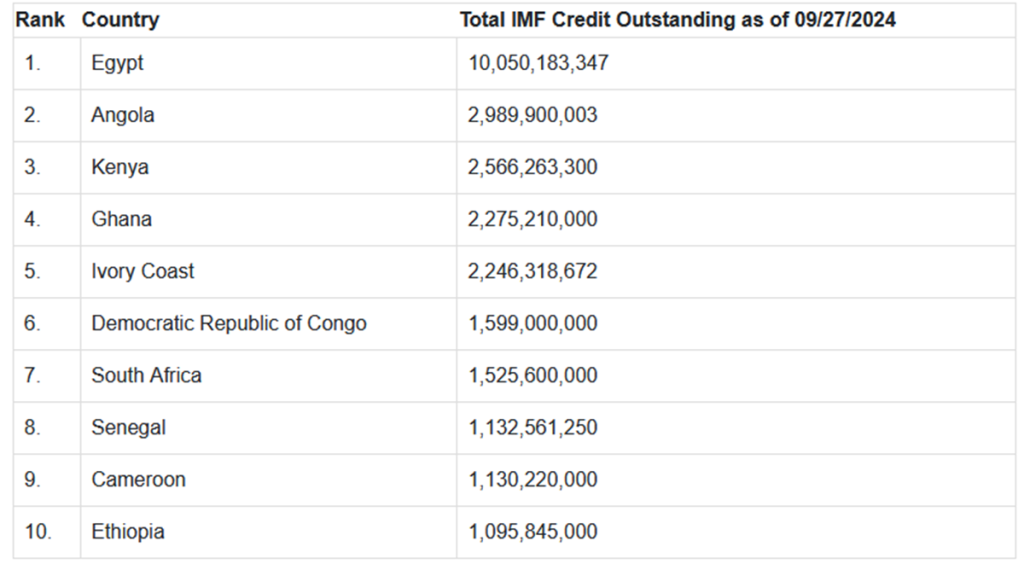

With that in mind, here are the ten African countries with the highest total IMF credit outstanding as of the start of Q4. The list was last updated on 27 September 2024.

Since July, Nigeria and Morocco have dropped out of the top ten, making way for Cameroon and Ethiopia.