Panelists at the just concluded Moonshot event organised by Tech Cabal have said that the approval of the Central Bank of Nigeria (CBN) is needed for open banking to become operational in Nigeria.

Open banking was first envisioned in Nigeria in 2017 with support from important stakeholders such as Sterling Bank, Flutterwave, Paystack, and banking leaders. The CBN’s endorsement is the final component needed for this initiative to move forward.

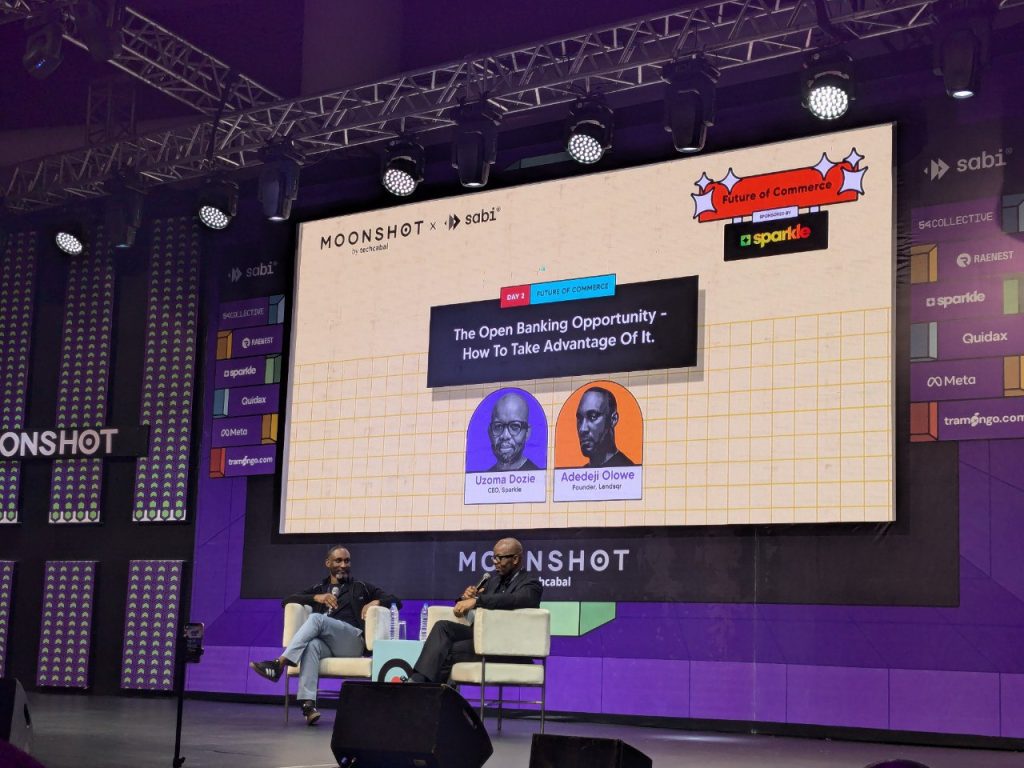

“All we need is CBN to blow the whistle to open banking,” Adedeji Olowe, the creator and CEO of Lendsqr, stated this during a fireside conversation with Uzoma Dozie, the CEO of Sparkle.

In 2023, the Central Bank of Nigeria (CBN) issued the first draft of a regulatory framework for open banking.

Olowe, a Trustee of Open Banking Nigeria, acknowledged that developing systems, regulations, and the alignment of participating financial institutions and regulators is challenging— a key reason open banking has yet to launch in Nigeria.

However, the increasing move toward open banking in Nigeria over the past seven years is understandable, as it has been successfully implemented in the UK to create a level playing field for its major lenders.

In addition to being among the first countries to adopt open banking regulations, the UK is also governed by the General Data Protection Regulation (GDPR), which establishes a solid legal framework for data protection, ensuring that users maintain control over their personal information.

Dozie noted that this same approach would be crucial for Nigerians, particularly for groups seeking credit.

Open banking enables banks and other financial institutions to share customer data with third-party providers, such as fintechs. This facilitates the creation of innovative financial products and services that benefit consumers, including lower-cost loans and customised budgeting tools.

This is especially relevant for Lendsqr, a digital credit management startup that firmly believes that access to banking information through open banking can lead to cheaper credit options for borrowers.

“Lenders want to know if they will get their money back. Open banking will ensure that they know who they are giving their money to,” “Lenders want to know if they will get their money back. Open banking will ensure that they know who they are giving their money to,” Olowe stated, emphasising that limited access to borrower information makes credit pricing risky and, consequently, lending more expensive.

Dozie and Olowe believe that regulators have effectively safeguarded the most critical aspect of open banking—data privacy. The National Data Protection Commission (NDPC), Nigeria’s governing body for data privacy, has been at the forefront of ensuring that open banking operates in accordance with the Nigeria Data Protection Regulation (NDPR). This regulation is vital for the success of open banking initiatives in Nigeria as it safeguards consumer data.