Africa is rich in natural resources, but many nations face challenges in fully utilising them due to a lack of functional refineries. This has led to a heavy reliance on imported refined petroleum products, costing the continent billions annually and negatively affecting its economies.

In 2023, Africa’s combined oil production capacity reached 7.2 million barrels per day, yet its refining capacity remains insufficient to meet the fuel demand.

Nigeria alone spent $600 million monthly on fuel imports as of August 2023. While some countries have made efforts to improve their refineries, including private initiatives to build new ones, the continent’s refining infrastructure remains underdeveloped.

Refineries not only process crude oil into essential products like gasoline and diesel but also play a crucial role in regional energy security and economic growth, as highlighted by the 2024 Refineries Watch report by Hawilti.

This dependence on fuel imports leaves African economies vulnerable to global oil price fluctuations, geopolitical tensions, and supply chain disruptions, further contributing to economic instability. However, efforts are being made to address these issues.

For instance, Nigeria’s Port Harcourt refinery recently began operations, and the government is backing the establishment of modular refineries. These initiatives reflect Africa’s commitment to reducing its reliance on imports and striving towards energy self-sufficiency.

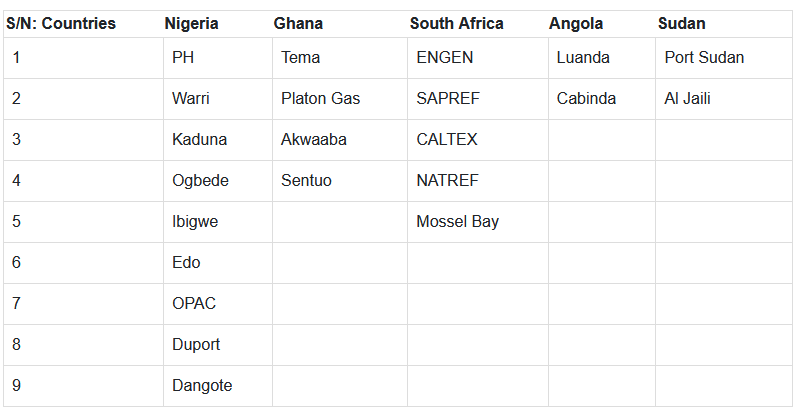

According to the Refinery Watch 2024 report, the table below shows the location of several refineries in Africa and their host nations.

Several African countries, including Zambia, Senegal, Côte d’Ivoire, Niger, Liberia, and DR Congo, each operate just one refinery. Other nations such as Chad, Gabon, Cameroon, Congo, and Kenya also contribute to the continent’s refining landscape.

West Africa has the largest refining capacity, although only about 30% of it is operational. The Dangote Refinery, with a capacity of 650,000 barrels per day, is expected to have a transformative impact on the region.

Refinery closures in Zambia and South Africa are likely to make Angola the primary refining hub by 2030. South Africa’s Central Energy Fund predicts the country will need to import around 604,000 barrels per day of petroleum products by 2025.

Investing in refinery construction and modernisation across Africa could reduce reliance on fuel imports, stimulate industrial growth, enhance energy security, and lower domestic fuel costs.