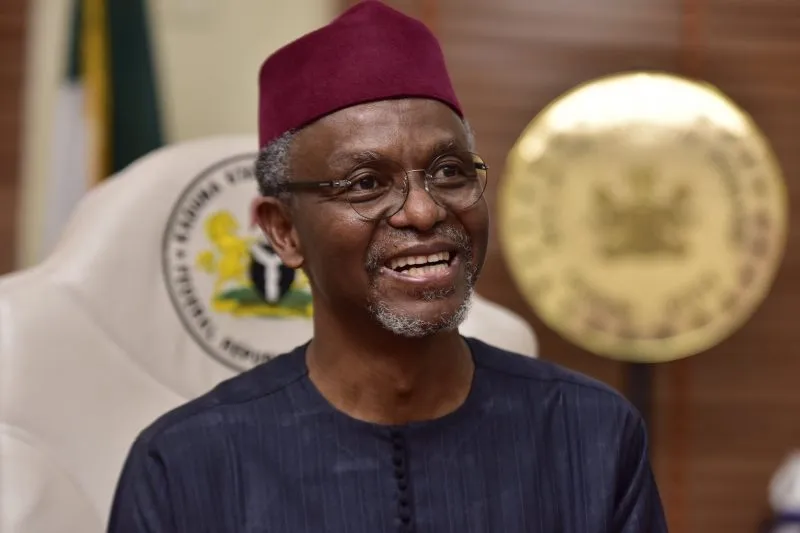

Nigeria’s Independent Corrupt Practices and Other Related Offences Commission (ICPC) has uncovered the alleged diversion of N1.37 billion from funds allocated to the now-abandoned Kaduna State light rail project during the administration of former Governor Nasir El-Rufai.

According to ICPC, the missing funds were part of the N11 billion released by the Kaduna State Government for the rail project. The anti-corruption agency disclosed its findings in a court application filed at the Federal High Court in Abuja, seeking the forfeiture of the allegedly diverted sum.

In its affidavit, ICPC stated that the misappropriation of these funds deprived Kaduna residents of a vital transport system. The agency claimed the fraud was carried out under the guise of a joint venture agreement between the El-Rufai-led government and Indo Kaduna Mrts JV Nigeria Limited in October 2016.

However, investigations revealed that payments were made to the entity before its official incorporation. ICPC alleged that El-Rufai approved N11.1 billion in payments to the company between December 2016 and January 2017, even though the Corporate Affairs Commission (CAC) did not formally register it until May 10, 2017.

Of the total sum paid into the company’s account with Sterling Bank, N1.373 billion was allegedly transferred into a private account, prompting the ICPC to seek an interim court order for its forfeiture. The agency also requested permission to publish a notice in national newspapers, inviting any individuals or entities with claims to the money to come forward before a final forfeiture ruling.

ICPC Chairman Musa Aliyu argued that reclaiming the funds for public projects aligns with the broader public interest and does not violate constitutional rights.

The investigation was initiated following a petition from Abuja-based lawyer M. Yahaya of NUS’ AB Chambers, received by the commission on 1 July 2024. The petition alleged large-scale financial misappropriation by officials from El-Rufai’s administration.

Documents reviewed during the inquiry showed that the Kaduna State Government signed an agreement with Indo Kaduna Mrts JV Nigeria Limited on October 18, 2016, for the construction of the light rail. Before the company’s formal registration, it opened an account with Sterling Bank on December 15, 2016.

Within a month, the Kaduna State Government deposited N11.1 billion into the account in multiple tranches. ICPC alleged that despite this significant down payment, no rail project was executed.

Premium Times reports that further investigations revealed that the funds were placed in a fixed deposit account rather than being used for the rail project. On the same day, Indo Kaduna Mrts JV Nigeria Limited received the last two payments, Jitender Sachdeva, Group President of Skipper Nigeria Limited, allegedly instructed Sterling Bank to place the money in an interest-yielding account.

By July 2019, the company returned N10 billion to the Kaduna State Government, but by then, the interest on the fixed deposit had accrued to N326.8 million. ICPC claimed that instead of being returned to the government, the interest was diverted into Skipper Nigeria Limited’s accounts.

Additionally, the remaining N1.046 billion was allegedly transferred in two tranches—N890.3 million and N156 million—to GTA Engineering Nigeria Limited’s accounts with Sterling Bank and Access Bank, under the guise of a feasibility study. However, ICPC found no evidence that any such study was conducted.

ICPC has since recovered the allegedly diverted funds—N1.046 billion from GTA Engineering and N326.8 million in interest—and is now seeking a court order to return them to the Kaduna State Government for public projects.

In response to the allegations, former members of El-Rufai’s administration dismissed ICPC’s claims, insisting that no wrongdoing took place. A statement issued on behalf of the former governor and his ex-appointees, which El-Rufai shared on his X account, described the move to seize the funds as an abuse of power and an attempt to discourage foreign investment.

They argued that the project was awarded to Skipper Nigeria Limited through a competitive tender and was structured under a Build, Own, Operate, and Transfer model. Under this agreement, Skipper was responsible for securing 85% of the funding from India’s Export-Import Bank, while the Kaduna State Government contributed 15% as equity.

According to them, the joint venture was legally registered in India before its Nigerian incorporation, making it eligible for financial transactions. They also stated that the project stalled because the Nigerian government failed to provide a Sovereign Guarantee, which was crucial for securing the necessary loan.

Despite these explanations, ICPC remains firm in its pursuit of the case, with a final ruling on the forfeiture application pending in court.