The Nigerian House of Representatives has initiated an investigation into the delayed disbursement of funds under the Conditional Cash Transfer (CCT) programme.

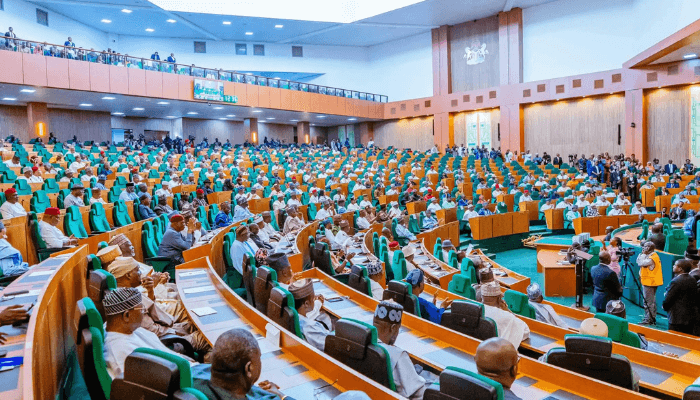

This decision followed a motion presented by Rep. Abass Adigun (PDP-Oyo) during a plenary session in Abuja on Wednesday.

Adigun highlighted that the Nigerian government, in partnership with the World Bank, launched the Social Safety Nets Programme for Nigeria in September 2016.

The initiative, implemented through the National Cash Transfer Office, provides financial support to low-income households under the Household Uplifting Programme.

As part of the programme’s latest rollout, selected beneficiaries were informed in August 2024 that they would receive ₦50,000 each for three months via direct bank transfers.

However, Adigun pointed out inconsistencies in the process, stating that while some beneficiaries received payments after long delays, many others had yet to be paid.

“The National Cash Transfer Office has not responded to the payment concerns raised by affected nominees,” he added.

Following this, Deputy Speaker Rep. Benjamin Kalu directed the Committee on Poverty Alleviation and Humanitarian Affairs to investigate the delays and submit a report within four weeks for further legislative action.

The programme faced a setback in January 2024, when President Bola Tinubu suspended it over corruption allegations.

However, the initiative was relaunched the following month, with the Nigerian government expanding its reach to 12 million additional households.

According to Nentawe Yilwatda, Minister of Humanitarian Affairs, Disaster Management, and Social Development, the government aims to cover 15 million households and 75 million individuals, providing each household ₦25,000 per month, three times a year.

“This initiative is part of President Bola Tinubu’s strategy to cushion the impact of economic hardship on vulnerable Nigerians,” Yilwatda stated.

He also noted that five million individuals have already received payments, and efforts are ongoing to sanitize the social register to ensure transparency.

To enhance accountability, the Central Bank of Nigeria (CBN) now requires beneficiaries to have a digital identity before receiving funds.

The Nigerian government also intends to leverage cash transfers to boost school enrollment rates and tackle the high number of out-of-school children in Nigeria.