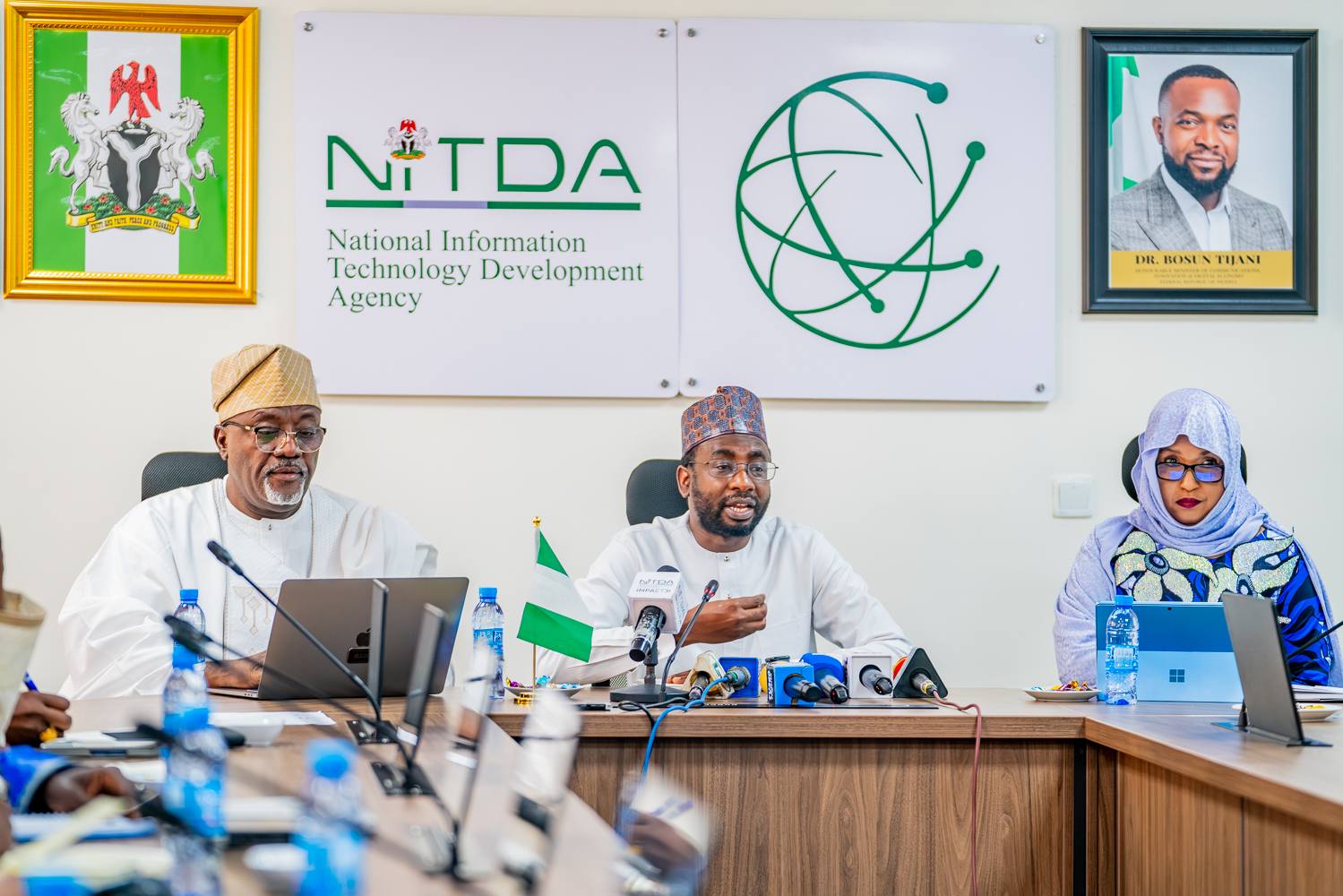

The National Information Technology Development Agency (NITDA) has met with the Nigeria Financial Intelligence Unit (NFIU) to present plans for the upgrade of the NFIU Data Management System and Compliance Platform under Project Exit.

This collaboration is a key move to address Nigeria’s financial challenges and enhance its digital transformation agenda.

The initiative follows the findings of the Mutual Evaluation Report (MER), which identified significant data and statistical analysis gaps, undermining the effectiveness of the nation’s Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) frameworks. These issues contributed to Nigeria being placed on the Financial Action Task Force (FATF) Grey List, with serious implications for the country’s global standing and access to international finance.

In response, President Bola Ahmed Tinubu approved NITDA to lead the enhancement of Nigeria’s AML/CFT/CPF Data Management Framework. The project aims to achieve FATF compliance, bolster NFIU’s operational capacity, and establish a long-term, sustainable data management system to improve Nigeria’s international financial reputation.

Attendees included Hon. Adedeji Olajide, Chairman of the House Committee on Information and Communications Technology and Cybersecurity; NITDA Director General Kashifu Inuwa Abdullahi; NFIU CEO Barrister Hafsat Abubakar Bakari, and senior officials from both organisations.