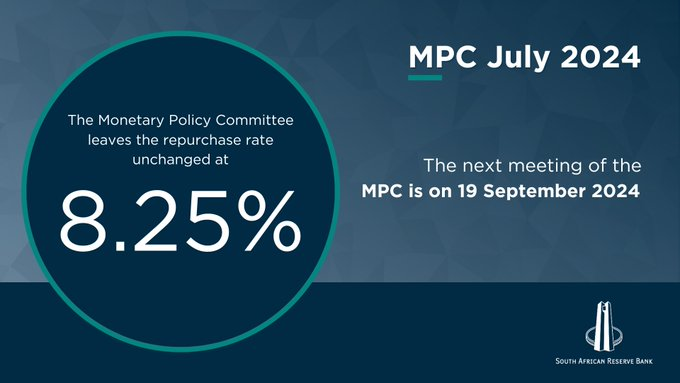

The South African Reserve Bank (SARB) has maintained its repurchase rate at 8.25%, a 15-year high, following the July Monetary Policy Committee (MPC) meeting in Pretoria on Thursday.

This decision keeps the prime interest rate of local commercial banks at 11.75%. Four MPC members supported keeping the rate unchanged, while two favoured a 25 basis point reduction.

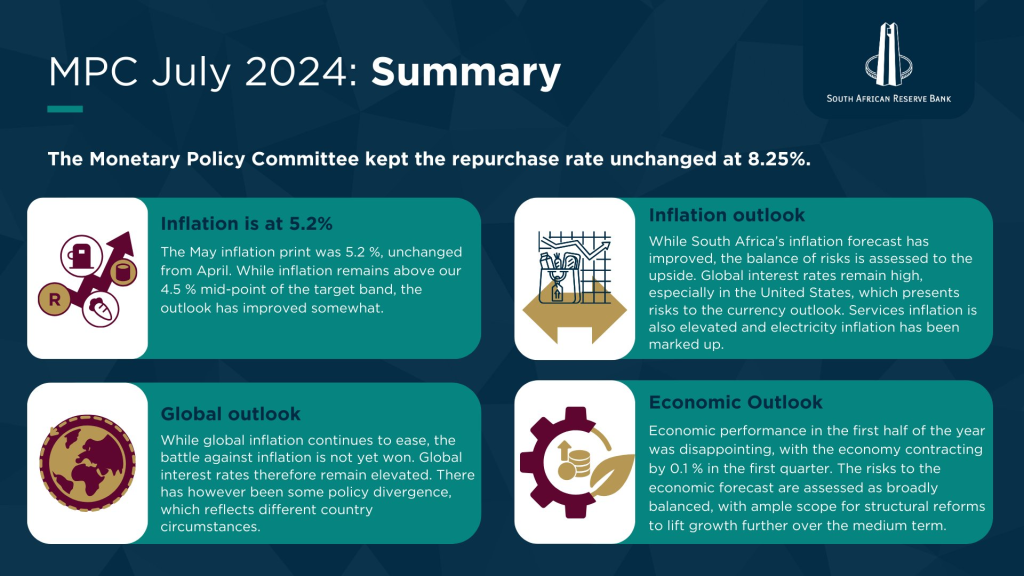

Although South Africa’s inflation is within the SARB’s 3% to 6% target range, it remains on the higher end, with the Consumer Price Index (CPI) at 5.2% in May.

SARB Governor Lesetja Kganyago explained that the MPC deemed a restrictive policy necessary to stabilise inflation at 4.5%. Some members felt the inflation outlook had improved enough to warrant a rate cut.

“The committee assessed that an unchanged stance remained appropriate, given the inflation risks. Some members, however, were of the view that the inflation outlook had improved enough to reduce the degree of restrictiveness,” he added.

Kganyago also noted that South Africa has the second highest inflation among G20 nations.

He said the fight against inflation wasn’t over yet, and most countries were yet to meet their inflation targets.

“The economy contracted by 0.1% in the first quarter and recent data, including last week’s mining and manufacturing numbers, have caused us to trim our second-quarter growth estimate modestly to 0.6%.”