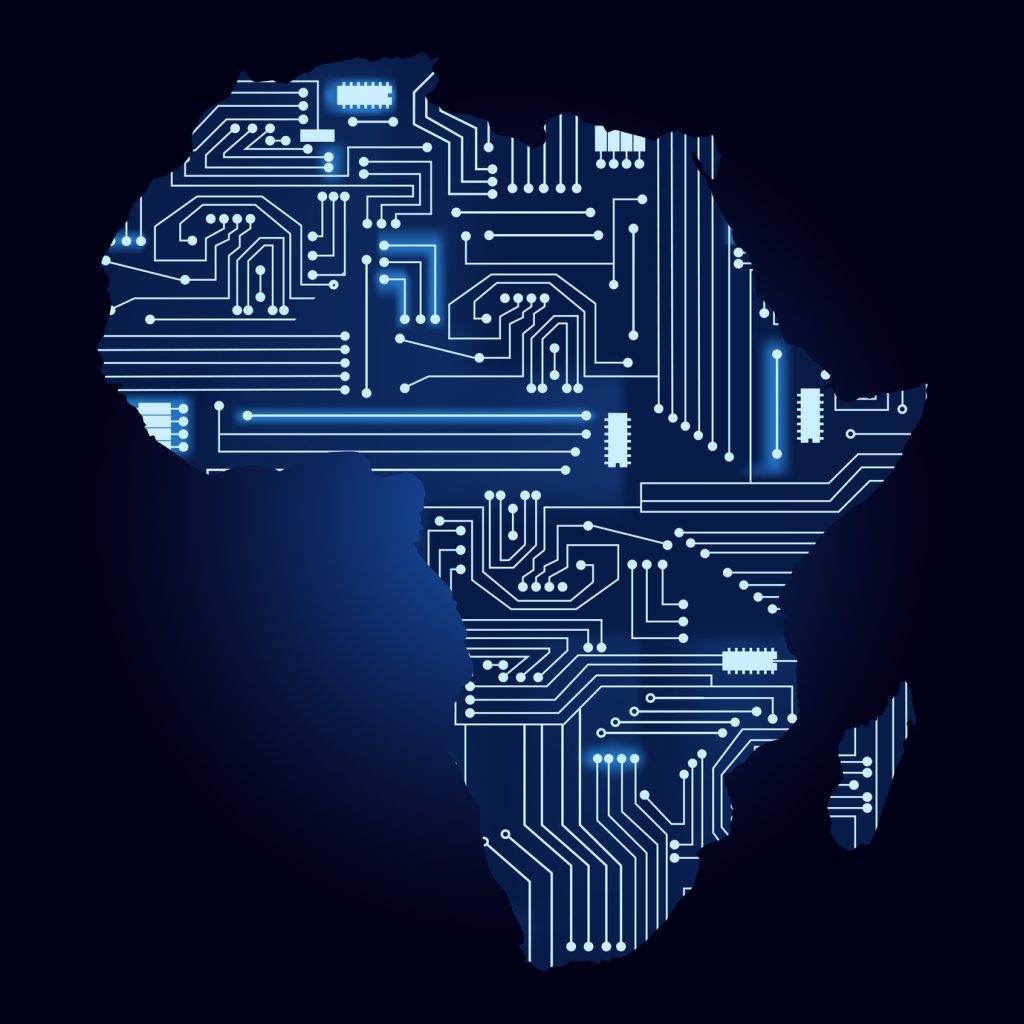

Africa is poised for rapid evolution across various sectors in its dynamic tech landscape in 2024. From AI to crypto to new investment patterns, several trends emerged in 2023 that will likely gain traction this new year.

So what’s next for the continent’s digital economy? Let’s check out some of the top trends to look out for this year.

Crypto

Cryptocurrency had some ups and downs in 2022, from Terra’s collapse to FTX’s implosion. But 2023 ended on a high with Bitcoin over 150% above its starting price point. Tokens like Solana also staged powerful comebacks, rising 1000% year-over-year. With crypto prices coming back strong, the market’s speculative nature may return in 2024.

Africa is already the fastest-growing crypto market in the developing world as people seek to check against inflation. Crypto also appeals to the youth seeking wealth-building opportunities with low barriers to entry. Higher prices are driving more funding into crypto startups and infrastructure.

Risks around volatility and criminality remain, The regulatory environment is gradually having to lessen its tough stance against cryptocurrency. In December, Nigeria’s central bank lifted its crypto trading ban, citing global trends that necessitate proper regulation rather than prohibition. If managed prudently, crypto adoption could spur financial inclusion.

Artificial Intelligence

Ever since ChatGPT dazzled the world, Artificial intelligence has exploded into the mainstream. Tech giants are now going head to head in a race to grab as much of the AI Pie as they can grab. There are new offerings like Google’s Gemini and xAI’s Grok competing with OpenAI. Vast funding poured into AI startups in 2023, with McKinsey reporting a 5-fold year-over-year increase in the first two quarters of the year.

In Africa, more startups are focusing on AI. Others are integrating it into their products. For instance, Nigerian fintech OnePipe uses AI for biometric identity verification and natural language processing.

AI startups attracted 25% of all funding in the U.S., showing its rising prominence. Demand for AI talent has also spiked globally.

But Africa’s biggest obstacle to an AI boom is insufficient data. Collecting and labeling quality datasets remains a challenge. This poses a massive opportunity for Africa, in research and data production firms in the coming years.

Mergers and Acquisitions

Mergers and acquisitions will likely continue as a survival strategy for startups in Africa. Dozens of deals have already occurred since 2022, including Risevest’s acquisition of Chaka and BioNTech’s purchase of InstaDeep. Many more struggling startups may seek exits to sustain themselves.

Outsourcing

Remote work for foreign companies has been a lifesaver with currencies in Africa weakening and inflation still high in 2023. Wage rates are also rising in traditional outsourcing hubs like India and China, potentially opening room for African talent.

With over 600 million youth entering the global workforce by 2030, Africa could contribute up to one-third of this demographic dividend.

Remote work helps absorb the 12 million youth that enter Africa’s job market annually. Apprenticeships and employment pipelines will need to scale up. Overall, startups facilitating tech training and placements are poised for strong growth.

Investor Sentiment

Investor preference across African regions could shift due to changing macroeconomic and political realities. Fifteen countries have major elections slated for 2024. Results will sway risk perceptions and direct foreign capital accordingly.

All said, Africa’s digital future looks bright but requires careful navigation. With sensible crypto regulation, ethical AI adoption, strategic consolidation, and global opportunities for talent, its tech ecosystem can prosper through uncertainty.