Many African nations have developed a deep reliance on the International Monetary Fund (IMF) as they seek solutions to address gaps in their economies. However, when African countries take on substantial debt from the IMF, they are often required to implement restrictive economic reforms known as Structural Adjustment Programmes (SAPs).

This has made the IMF’s role in Africa a contentious issue, raising the question of whether securing loans from the global lender causes more harm than good.

Although the IMF provides financial aid to countries facing economic crises, the substantial debts owed by many African nations have become a growing concern. While these loans are intended to stabilise economies, they frequently lead to significant challenges that can hinder development and undermine long-term growth.

Moreover, high levels of IMF debt often trap nations in a cycle of borrowing and repayment. Servicing these loans diverts substantial portions of government funds away from productive investments and towards debt repayment.

This, in turn, reduces the fiscal flexibility needed to address external shocks such as fluctuating commodity prices, natural disasters, or global financial crises.

Without adequate resources to mitigate such challenges, countries become increasingly exposed to economic vulnerabilities, worsening the hardships they face.

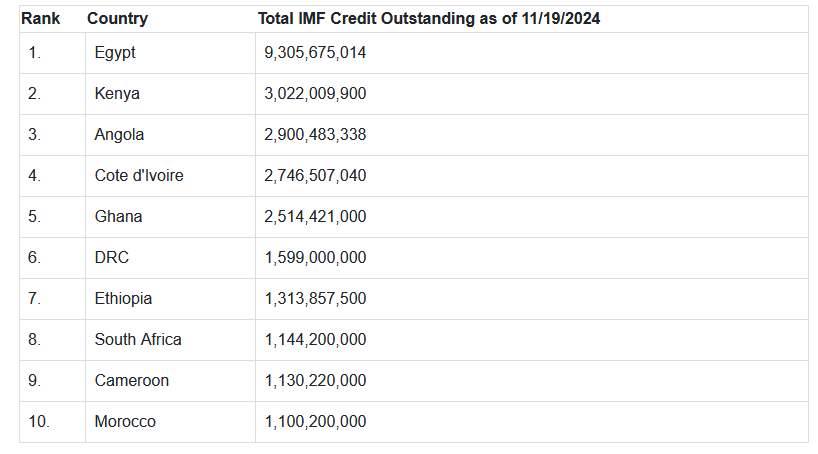

With this in mind, here are the 10 African countries with the highest total IMF credit outstanding at the end of 2024.