Heavy government debts may lead to various economic challenges, especially in certain African countries. These difficulties often involve a decrease in the value of the currency and a decline in investor trust, among other issues. Consequently, governments are responsible for reducing their debt burden, although many struggle to do so.

According to the most recent Africa Pulse report from the World Bank, the external public and publicly guaranteed (PPG) debt in Sub-Saharan Africa has steadily increased over the past ten years. The report highlights that the debt has more than quadrupled since 2006. The total external debt of PPG rose from US$108 billion in 2006 to US$462 billion in 2022.

In Sub-Saharan Africa, bilateral Paris Club creditors provided less external funding, while bilateral non-Paris Club creditors provided slightly more. In 2006, bilateral Paris Club creditors represented 22% of foreign debt in Sub-Saharan African countries, a percentage that would decrease to 5% by 2022.

Before the global financial crisis, the top six bilateral creditors of Sub-Saharan Africa were France, China, the US, Japan, Saudi Arabia, and Kuwait. Currently, China is the leading creditor. Foreign investors consider countries with high debt-to-GDP ratios riskier, leading to higher interest rates on future loans. This increases the cost of servicing the debt, resulting in a cycle of borrowing to repay previous debt.

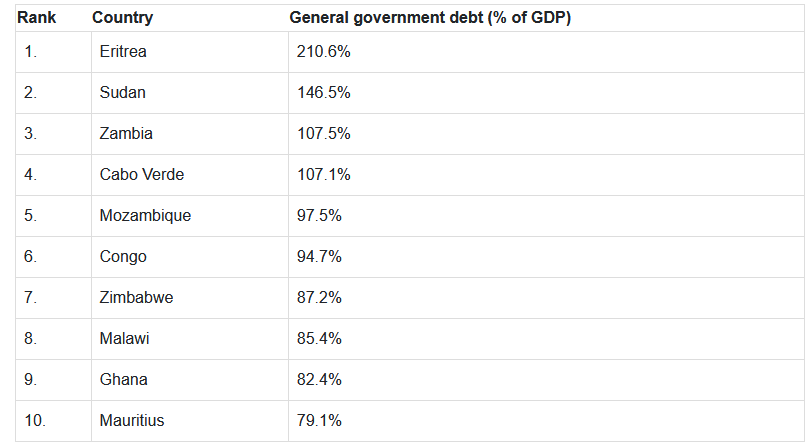

Below are the ten Sub-Saharan African countries with the highest debt as a percentage of their GDP, according to the Africa Pulse report.