The personal income tax rate indicates the portion of a person’s earnings paid to the government as tax, which can differ significantly among various African nations. While a few countries impose a reasonably low tax rate, others have a considerably higher one.

A high personal income tax can affect workers’ net earnings, drive, and general well-being. A high PIT rate diminishes a worker’s net income since a large share of their earnings is taken as tax, leaving them with fewer funds to spend on products and services, save for retirement, or invest in their future.

Governments view personal income tax (PIT) as a means of generating revenue that funds public goods and services, infrastructure, and social initiatives. In Africa, foreign workers are also liable for PIT; however, certain countries have adopted tax-friendly policies, including reduced PIT rates or exemptions, to attract foreign talent and investment, thereby fostering economic growth.

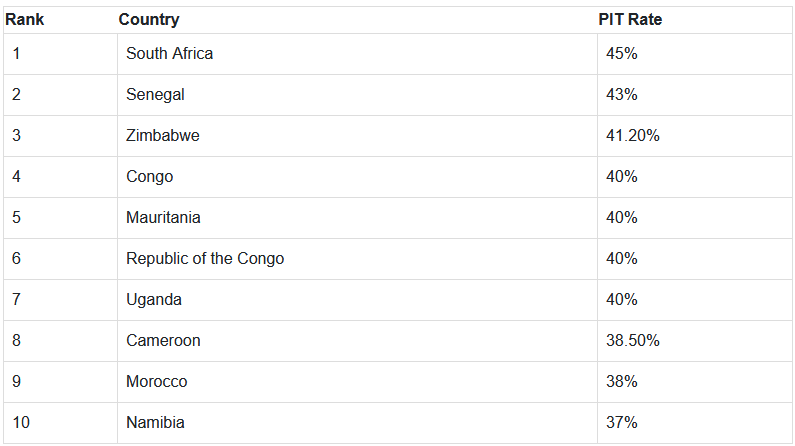

Determining personal income tax varies across countries and is shaped by numerous factors. According to Trading Economics, as of 2024, the African nations with the highest personal income tax rates are seen below.