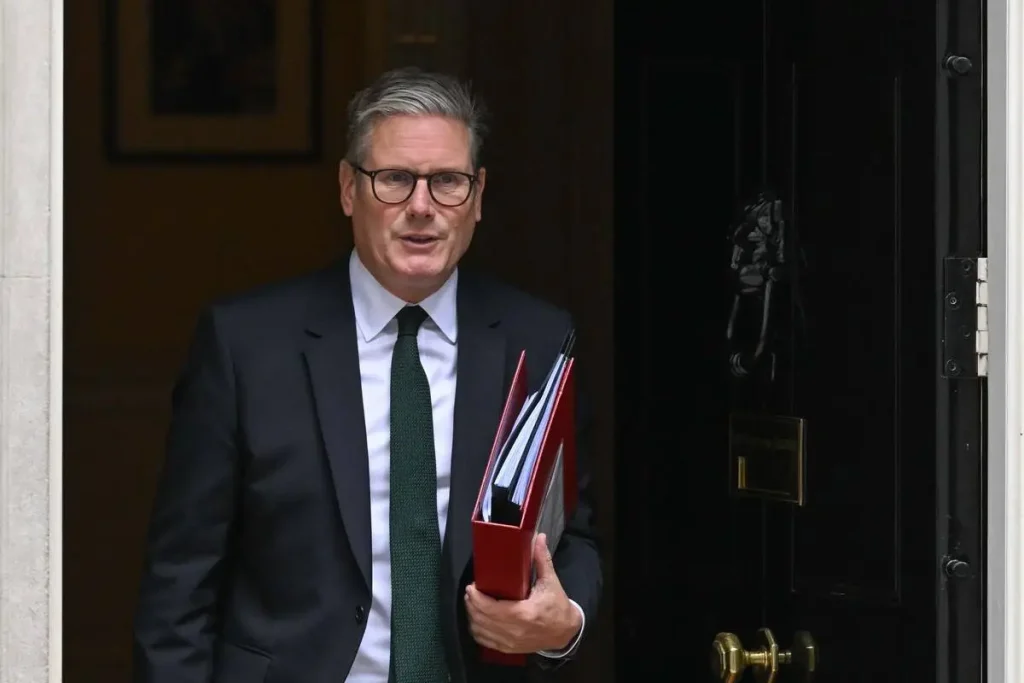

The new Labour government in Britain announced significant tax increases and higher borrowing on Wednesday to support Prime Minister Keir Starmer’s vision of long-term investment for growth.

In the highly anticipated fiscal update—the first from the centre-left government following 14 years of Conservative leadership—Finance Minister Rachel Reeves outlined tax rises expected to generate an additional £40 billion ($52 billion).

Investing for Growth

In her hour-long address to Parliament, Reeves also confirmed changes to fiscal rules allowing the government to allocate billions more to public services.

“This government was given a mandate,” Reeves stated, “to restore stability and to initiate a decade of national renewal. The only path to economic growth is to invest, invest, invest.”

Following a landslide victory in the July general election, Labour had already unveiled a suite of economic policies, including enhanced workers’ rights, higher minimum wages, an ambitious green-energy initiative, and plans for substantial new housing. However, the government faced criticism ahead of the budget for cutting a winter-fuel benefit scheme for millions of pensioners, which affected Starmer’s polling approval.

“I am restoring stability to our public finances and rebuilding our public services,” Reeves reiterated. She said £25 billion would be raised by increasing employers’ national insurance contributions, a payroll tax supporting social care.

The pound gained value as Reeves presented the budget, although London’s stock market remained steady. “Significant tax hikes have not yet unsettled financial markets,” noted Kathleen Brooks, research director at trading firm XTB. The government upheld its commitment not to raise income tax, employee national insurance contributions, or VAT.

Outgoing Conservative leader Rishi Sunak criticised the budget, calling it “broken promise after broken promise” and accusing the government of imposing “a wave of anti-business regulations.”

Borrowing for Infrastructure

Ahead of her tax-and-spend strategy, Reeves implemented a technical change in how UK debt is calculated, enabling greater borrowing even as public sector debt levels reach those last seen in the 1960s. Reeves plans to use a broader debt measure that factors in future returns on investment to support additional funding.

The increased investment will target infrastructure, including school repairs, teacher recruitment, and childcare support. In a surprise announcement, Reeves extended the freeze on fuel duty for another year. The NHS will receive a substantial boost, with an increase of nearly £23 billion to its day-to-day budget.

Paul Johnson, director of the Institute for Fiscal Studies, cautioned that “the challenge will be to ensure the funds are effectively spent to justify the costs of borrowing.”

Economic Growth Projections

Reeves announced that Britain’s economy is expected to grow faster than previously forecast for 2024 and 2025, with GDP estimated to rise by 1.1% in 2024 and 2.0% in 2025—exceeding earlier projections from the Office for Budget Responsibility (OBR). Britain’s economic outlook has improved as inflation rates fall below the Bank of England’s 2% target, easing the cost-of-living crisis. The International Monetary Fund also forecasts a 1.1% growth rate for the UK economy in 2024.

However, the OBR revised its growth forecasts for 2026 to 2028, projecting a slower pace beyond the coming years.